Singapura Finance is dedicated to providing our customers with a secure financial service environment. We use advanced security software and technology to protect and safeguard your accounts and transactions. We will not call you or send you any unsolicited email/SMSes asking for your banking credentials, Password, OTP and/or Mobile PIN. Measures put in place to provide our customers with a safe banking environment includes:

- Secured login using Two-Factors Authentication (2FA) and/or Touch/Face ID

- Multi-Factor Authentication for secured transactions. All transactions require a Mobile PIN and/or soft token PIN known only to you

- Geo-Fencing. As the majority of hacking comes from overseas based hackers, we have disabled access to SFL iBIZ and SFL Go from any foreign domain. This will reduce the opportunity for hackers to take control of your account

- Limited Transaction during after office hours. Transactions created after office hours are put on hold and will only be processed the next business day giving you time to review or cancel unauthorised transactions

Notwithstanding all the security measures, if you suspect you have been a victim of fraud or notice any suspicious and fraudulent transactions, please call our Customer Service Hotline at 6880 0668 (9 a.m. to 4.00 p.m. during office hours) to freeze all transactions.

You may also use the Kill Switch to hold all transactions. If you believe that your account has been compromised send a SMS using your registered mobile number to activate the Kill Switch. When Kill Switch is successfully activated, all outgoing transactions including standing instructions performed using SFL Go for all your deposits account will be stopped.

The format for the SMS is as follows:

Example: REQ BLOCK 484G 230595

You can also go to SFL Website > Services > SMS Banking to send the SMS using the provided QR code.

You will receive a SMS and email confirmation that the Kill Switch has been activated. Our Customer Service Officer will contact you as soon as practical to further verify your instructions. Until such time, all pending transactions including standing instructions performed using SFL Go for all your deposits account will be stopped. As such, the Kill Switch should only be used in emergencies where you are sure that your accounts have been compromised.

- Be mindful of scams. Keep up to date with the latest security/scam news that might affect you and the way you bank or perform online transaction. For more information visit https://www.scamalert.sg/ and https://www.ncpc.org.sg

- Ensure that you are on Singapura Finance’s official website or use our SFL iBIZ or SFL Go mobile app only to perform your online transactions

- Singapura Finance staff will not ask you for your login credentials, OTP or Mobile PIN for any purpose including unlocking your account

- Do not give your account number, login credentials, Password, OTP or Mobile PIN to any 3rd parties or use it on non-Singapura Finance’s webpage

- Do not click on any clickable links in messages or emails. Singapura Finance will not include any clickable links in our communication with you

- If you suspect that you have been a victim of a scam, lodge a police report at https://www.scamshield.org.sg, change your password and/or Mobile PIN and contact our Customer Service Hotline if you need to block any pending transactions

Job Recruitment Scams

Singapura Finance do not do recruitment using messaging apps or via social media.

We also do not have job openings in international markets except Singapore.

If you receive any unsolicited job offer via messaging apps or see any job advertisement purporting to be from us on any job

portal that ask you to contact them via messaging app or call an international phone number, it is likely to be a scam.

If in doubt, please call our Human Resource department.

Hoax Phone Calls/Foreign Branches

The callers pretend to be from Singapura Finance asking customers to deposit money into Singapura Finance’s "branch"

in a foreign country. Singapura Finance do not have any branch overseas and only maintained branches in Singapore.

Singapura Finance will also not make cold calls soliciting for deposits.

If in doubt, please call our Customer Service Hotline.

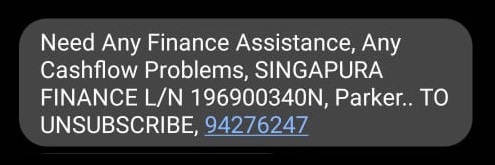

SMS Scam

Scammers use unsolicited messages sent via the messaging platform to members of the public purportedly from

Singapura Finance offering loans or finance assistance.

Singapura Finance will not send you any unsolicited emails or SMSes of such nature without obtaining your prior consent.

If you receive any such messages, kindly disregard them.

Example of a SCAM SMS:

Phishing / Fake Website Scams

Scammers use fake website with similar sounding name as Singapura Finance to lure customers to key in their

banking credentials and OTP. Do not click on URLs in unsolicited emails and text messages.

Always type our official web address into your web browser to ensure that you are at the correct official website.